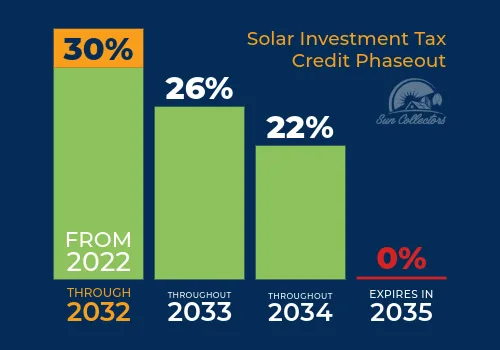

Solar system owners can claim up to 30% of the entire cost of new solar power systems installed from 2022 through 2032 on their tax returns by claiming the federal solar tax credit.

The value placed on the benefit to the community when your solar system generates power is measured in SRECs. Thanks to the Illinois Shines program, these credits can recuperate 20-35% of the cost of your system.

Illinois solar consumers are not required to pay taxes on assessed value which was added to their property by a solar system or solar battery.

Ameren Illinois provides a rebate of $300/kW (DC) to solar system owners using smart inverters to interconnect their solar power system to the grid.

Excess electricity that is generated by your solar panel system and sent to the grid offsets the electrical supply costs on your utility bill at a 1:1 rate. Unused credits roll over each month and do not expire.

The Rural Energy for America Program (REAP) offers financial assistance to agricultural producers and small businesses in rural Illinois. Find out if you qualify and learn how to apply for guaranteed grants and loans to cover up to 50% of your agricultural solar system costs.

Learn about the state-run program that makes solar energy more accessible and affordable for residents, businesses, and communities across Illinois by offering additional benefits like SREC incentives and consumer protection.